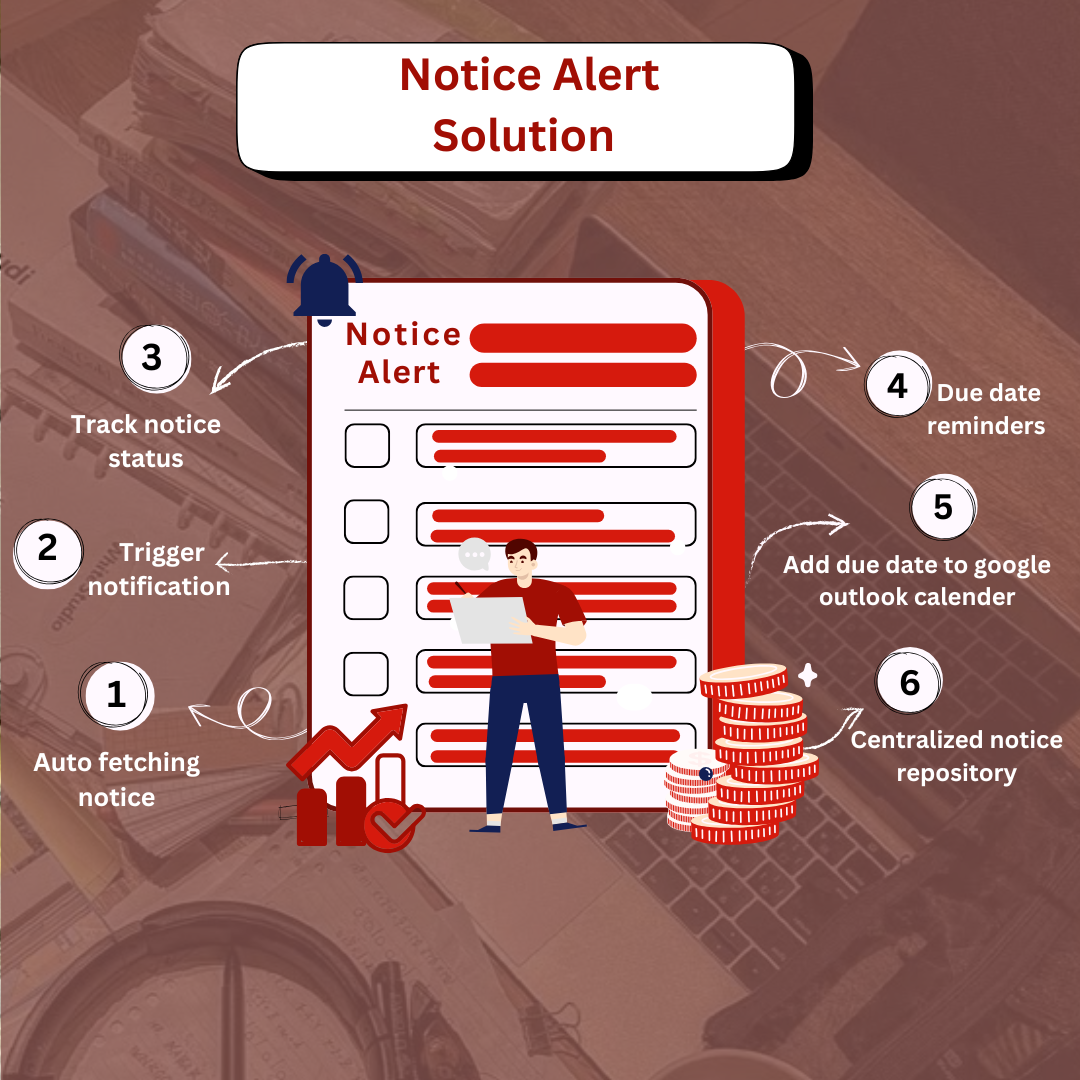

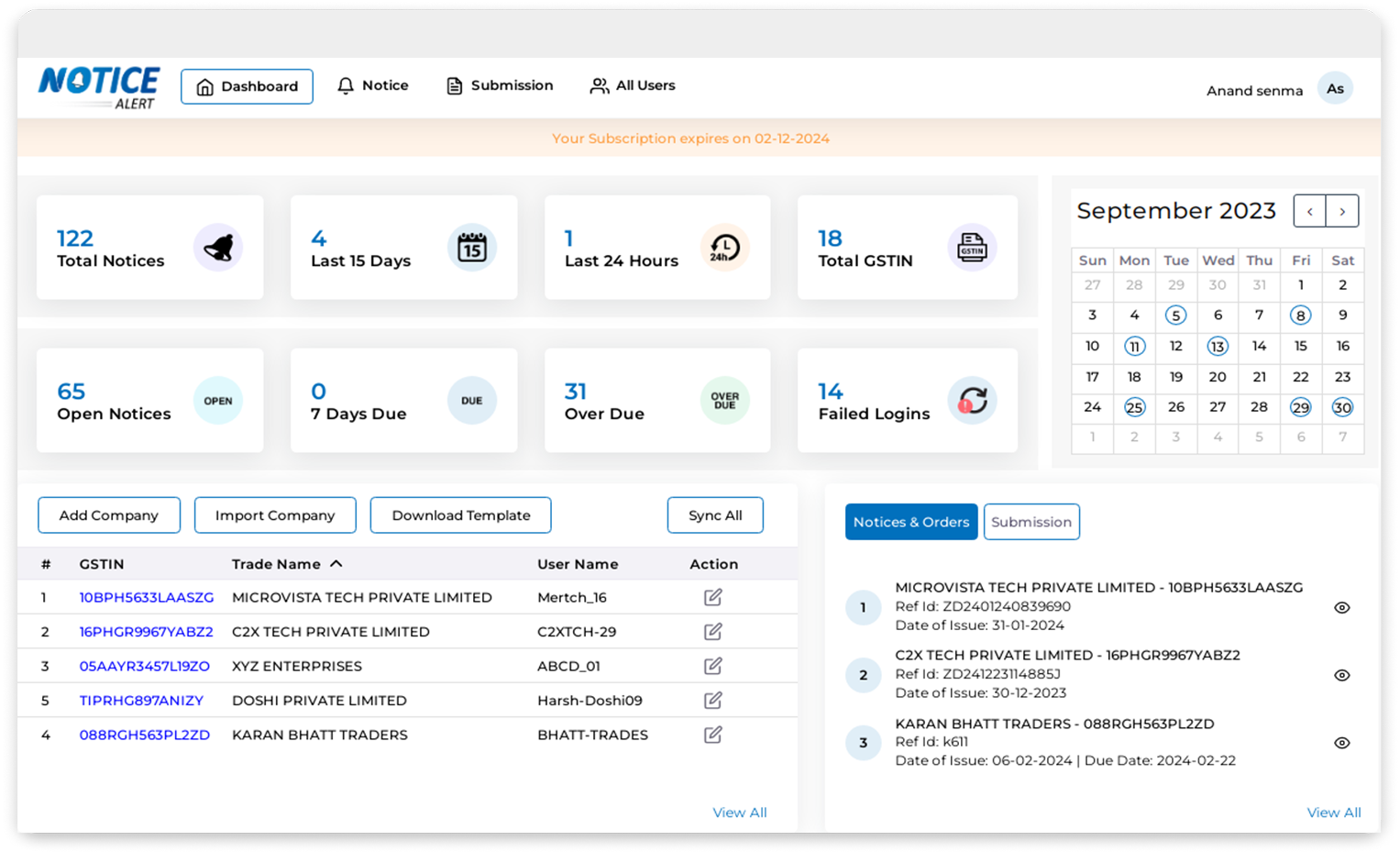

Notice Management - Managing of GST, Income Tax & TDS notices including Response, Deadlines & Stores in Centralized System

"Stay Informed, Stay Compliant: Notice Management Keeps You Ahead!"

Get in touch to discuss your project